Credit Report Analysis

Credit Report Analysis: Helping You Raise Your Credit Score

Your credit score is the number assigned to let lenders know how you’ve handled paying your creditors. A low score can make it nearly impossible to buy the home or car you want. Many employers also now use credit scores to vet potential hires.

If you have a low credit score, the good news is you can improve it!

At CCCS, we are passionate about helping people improve their credit scores. That’s what our credit report analysis service is all about! Our counselors can help you correct errors, decide what old debts need to be addressed and eventually improve your score.

What Does Credit Report Analysis Include?

Our credit report analysis centers on building a helpful, judgment-free relationship. You won’t just receive an impersonal credit analysis report. Instead, one of our counselors will sit down with you for a two-hour session to go over your credit report in detail.

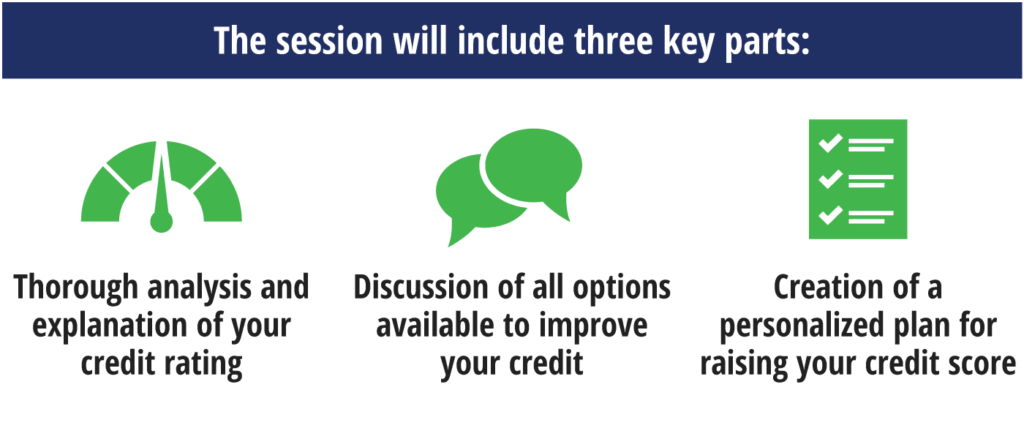

The session will include three key parts:

You will leave the session with your questions answered and a plan to address and solve issues on your credit report.

How Much Does This Service Cost?

As a nonprofit credit counseling agency, we are proud to offer our credit counseling sessions free of charge. However, we charge a fee of $25* to analyze your credit report. We also accept donations to help cover costs.

If you want to check your credit report, you can get one free from each of the three credit bureaus at www.annualcreditreport.com.

*Fee can be waived if grant funding is available.

What Are the Benefits of Credit Report Analysis?

Why come to CCCS to get help with your credit score? Here you will receive a personalized and relational approach. In other words, you will get all of the following benefits:

- One-on-one coaching from a financial expert

- A clear breakdown of your credit report

- A plan to improve your credit that is tailored to your situation

- Tips for maintaining a good credit score in the future